CB Insight 'State of Venture 2024' Report: Insights and Advisory

Last week, CB Insights published its ‘State of Venture 2024’ report, which shared insight on global venture capital trends, funding patterns, and investment shifts.

The findings highlight the most significant investment themes, emerging technologies, and the geopolitical factors shaping the venture capital ecosystem. With funding levels reaching an eight-year low, this analysis offers critical insights for start-up founders, investors, and policymakers seeking to navigate a rapidly evolving investment market.

The Evolving Landscape of Venture Capital in 2024

The global venture capital ecosystem is undergoing a transformation. Venture capital (VC) investment hit an eight-year low in 2024, reflecting economic uncertainty, shifting investor priorities, and evolving geopolitical dynamics. Yet, despite the decline in total deal volume, some sectors—most notably artificial intelligence (AI), climate tech, and advanced healthcare innovations—are attracting significant capital.

Understanding these trends and knowing how to position one’s start-up is becoming critical for founders, corporate executives, investors, and government policymakers.

After reading the report, I wanted to share what stands out for me about the investment patterns shaping the venture capital ecosystem in 2024, looking at which countries are leading the charge and what start-ups and governments do to attract more investment to support the innovation that is taking place.

Investment Trends in 2024: Where Is the Money Going?

AI is Dominating Venture Capital

If one sector defines venture capital in 2024, it is artificial intelligence (AI). AI investments accounted for 37% of total venture funding, a record high. With nearly three in four AI deals being early-stage, investors are betting on AI’s potential for disruption. Databricks ($10B), OpenAI ($6.6B), and xAI ($6B) were among the top five largest AI-related deals of 2024.

CB Insight: State of Venture 2024

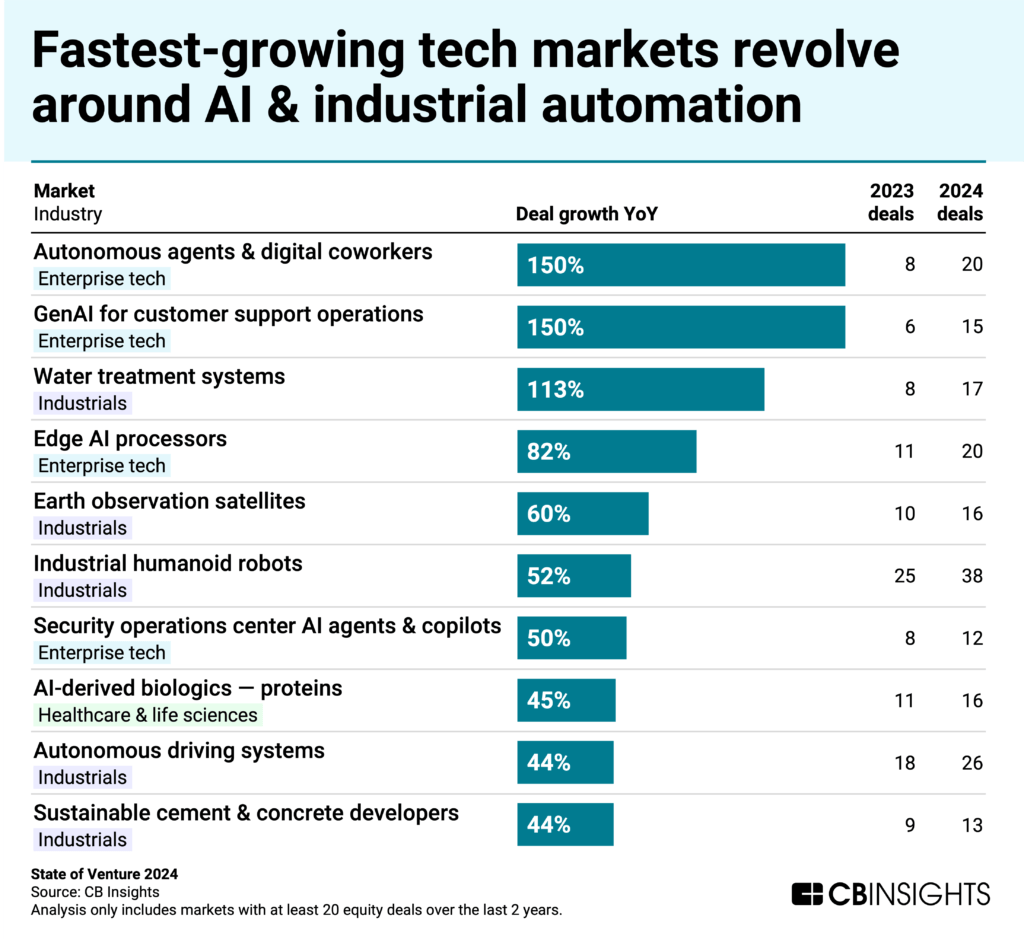

The fastest-growing AI sub-sectors include:

Enterprise AI agents and automation tools.

Generative AI for customer service and digital content creation.

Autonomous driving systems and industrial humanoid robots.

Fintech Faces Challenges, But High-Potential Startups Still Secure Investment

The fintech sector, once a dominant force in venture investment, has seen a slowdown. Funding has declined from $143.6B in 2021 to $33.7B in 2024. However, particular areas, particularly AI-powered financial services and blockchain innovations continue to draw interest.

Notable fintech deals include Uala ($300M), Current ($200M), and Zepz ($267M Series F). Start-ups offering embedded finance, alternative lending solutions, and AI-driven risk management can still raise capital, provided they demonstrate sustainable unit economics and a clear path to profitability. Again, it's all down to how the opportunity is presented.

Energy, Climate Tech, and Advanced Healthcare on the Rise

While traditional investment sectors struggle, funding is flowing into renewable energy, nuclear technology, and biotech. Key deals included:

Pacific Fusion ($900M Series A) in clean energy.

X-energy ($500M Series C) in nuclear technology.

Metsera ($215M Series B) in biotech innovation.

Venture firms see long-term value in companies addressing climate change, energy security, and healthcare advancements—sectors that are benefiting from both technological innovation and government-backed incentives.

Equally, with the appetite for investing in AI taking the lead, the opportunity exists for start-ups and other companies that support the delivery and establishment of AI, such as energy.

Which Countries Are Leading (and Lagging) in Venture Capital Growth?

Winners: Countries With Resilient or Expanding Venture Ecosystems

Despite a global slowdown, certain regions continue to attract substantial investment:

The United States remains the dominant VC hub, with $60.8B in Q4 2024 and continued strength in AI and deep-tech.

Asia’s VC ecosystems in Japan, India, and South Korea are expanding, bucking the global trend. Japan is one location, where it’s companies are investing in innovation through their respective CVC units.

The UK remains Europe’s strongest venture capital hub, particularly in fintech and AI, an area that is supported by the UK government’s recently published ‘AI Opportunities Action Plan,’ which is being challenged by France’s Artificial Intelligence Action Summit that is taking place this week and at which President Macron will signal ‘investments of 109 billion euros in French AI by the private sector.’

Losers: Markets Facing a Decline in Investment

China’s VC ecosystem shrank by 33% year over year, driven by geopolitical tensions, increased government intervention, and US restrictions on semiconductor exports. A looming trade war between the world’s leading economies will impact how China is perceived as an investor, even though the US is building bridges by imposition of tariffs on many of its allies.

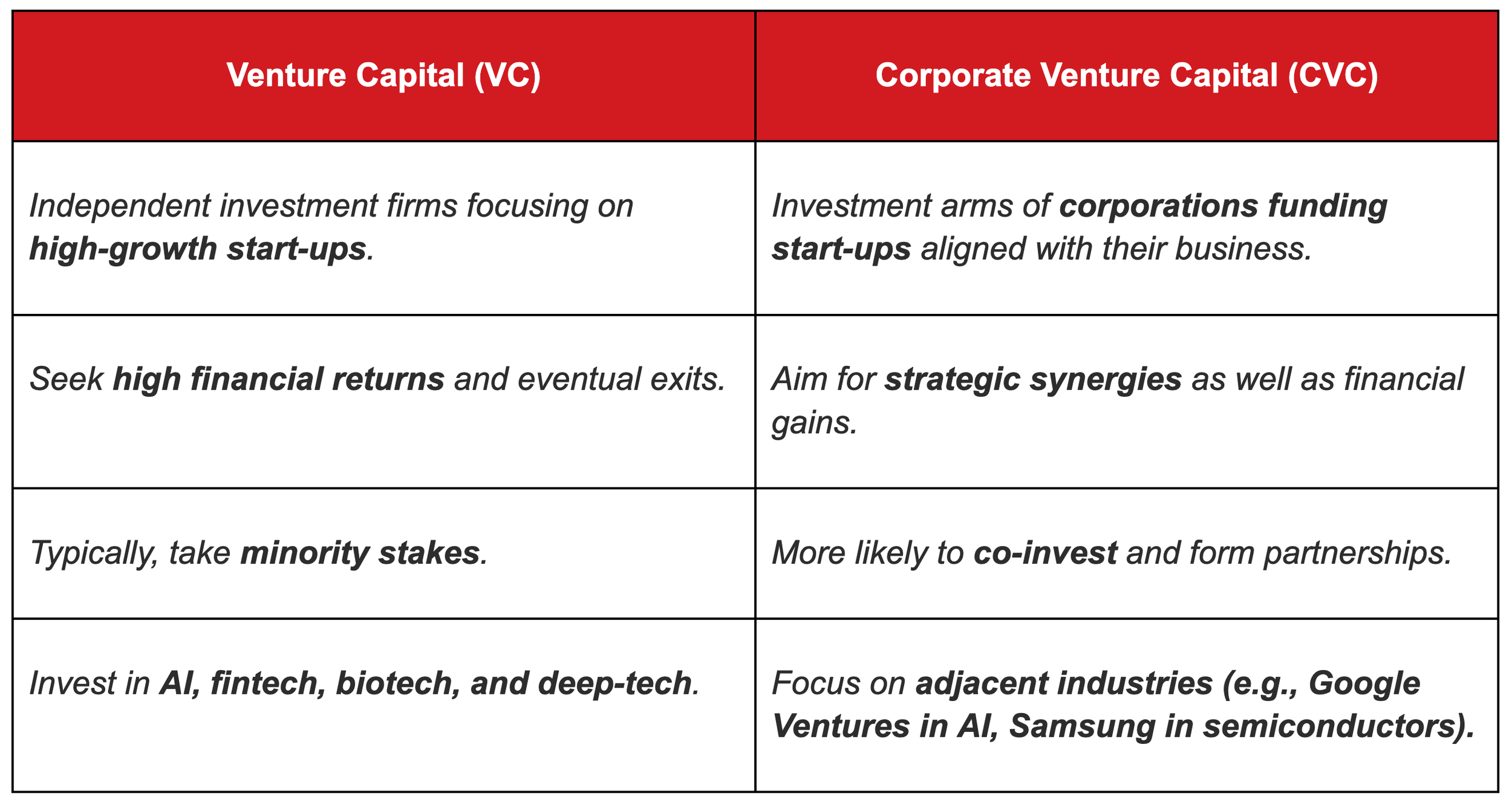

Venture Capital vs. Corporate Venture Capital: Understanding the Differences

Twofourseven Strategy: Differences between VCs and CVCs.

In 2024, Google Ventures (27 deals), Mitsubishi UFJ Capital (21 deals), and Samsung NEXT (9 deals) emerged as leading CVC investors.

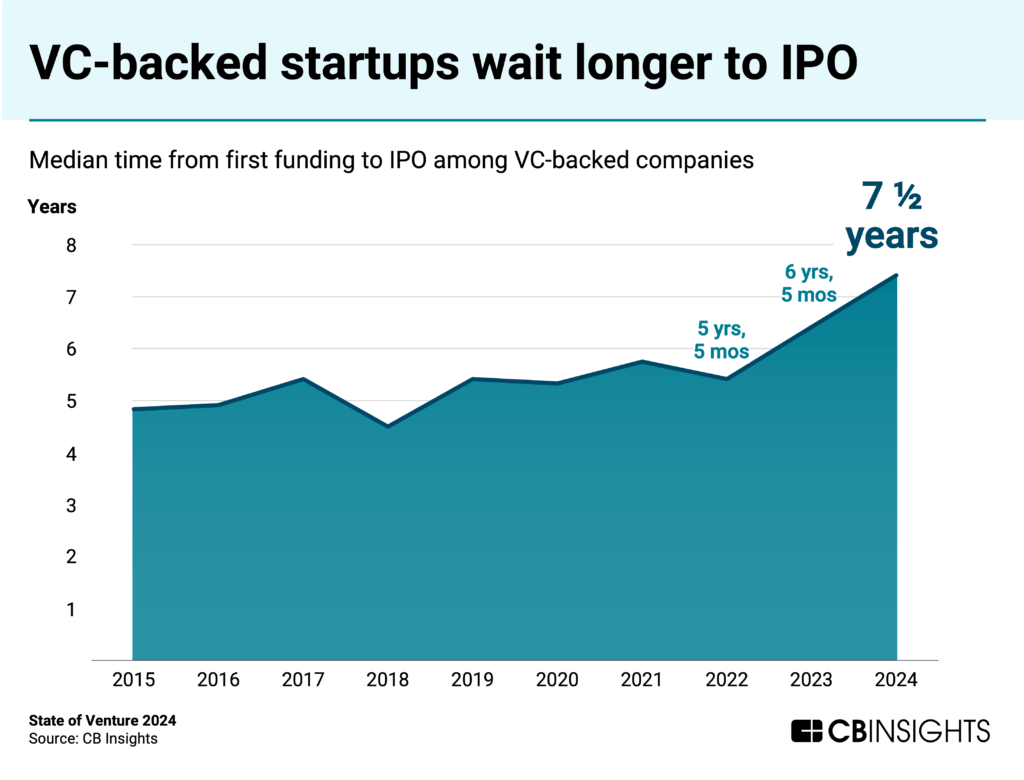

How Can Start-ups Secure Investment in 2025?

With a tougher investment climate, start-ups must adapt to secure funding. Positioning, Perception and Profitability will influence how successful start-up challengers succeed. Here are some strategic views on what founders need to focus on:

Incorporate AI and Automation: Investors prioritise start-ups leveraging AI to improve efficiency, productivity and scalability.

Show a Path to Profitability: The growth-at-all-costs model is over. Sustainable business models with clear revenue strategies are more attractive to investors.

Seek Strategic Partnerships: Aligning with corporate venture capital (CVC) investors can provide credibility and long-term support.

Strengthen Regulatory Compliance: Fintech, AI, and healthcare startups must proactively address regulatory concerns to reduce investment risk.

In these areas, investing in strategic communications and advisory can help companies navigate the challenging economic climate in which innovation is taking place.

The difficult choice for the business and public sectors is that to secure growth, they need to invest and pump prime opportunities.

CB Insight: State of Venture 2024

Geopolitical Risks and Government Policies Affecting Venture Investment

Geopolitical Risks Impacting VC Investment

US-China trade tensions are slowing cross-border investments in technology.

Increased AI regulations in Europe and the US are affecting investment decisions.

Rising protectionism in national markets is leading to more scrutiny over foreign investments in sensitive sectors.

Government Policies That Help or Hinder Venture Growth

Countries Supporting VC Growth:

The UK and Singapore offer tax incentives and innovation-friendly regulations, attracting foreign VC investment. Watch out for more policy changes to help attract investors, businesses and opportunities. Understand how there is a need for public-private collaboration, and equally collaboration and support to academic institutions.

Japan and South Korea provide government-backed funding programs to stimulate local venture ecosystems.

Countries Hindering VC Growth:

China’s capital controls and tech sector crackdowns are deterring foreign investors. Given how China is perceived, there is a needs to directly and inderectly reposition itself.

Germany and Canada’s bureaucratic hurdles are slowing down VC deal-making.

Strategic Recommendations for Governments to Attract More Venture Capital

Governments play a pivotal role in shaping the venture capital ecosystem. To attract more investment and foster innovation, policymakers should:

Create Clear AI and Fintech Regulations: Start-ups and investors need predictable, transparent rules to operate confidently. There is a huge need to simplify and redesign the regulatory landscape.

Offer Tax Incentives for Innovation: While expanding R&D tax credits and government-backed funding schemes can drive more venture activity, conversations with businesses, innovators and investors will help governments to re-design an environment where everyone can win.

Encourage Public-Private Collaboration: Corporate venture capital arms are increasingly influential. Governments should facilitate partnerships between start-ups and corporate investors.

The Future of Venture Capital in 2025 and Beyond

Despite global economic headwinds, venture capital remains a critical driver of innovation and economic growth.

Start-ups that leverage AI, demonstrate financial sustainability and build strategic partnerships will be best positioned for success. Meanwhile, governments that create favourable regulatory environments and incentivise investment will continue to attract venture capital and corporate venture capital activity.

The next wave of innovation is already taking shape. The question for investors, start-ups, and policymakers alike is: How will you position yourself for success in the evolving venture landscape?

Get in touch if your business or investment portfolio needs counsel, strategic communications support and advisory.

Strategic communication and stakeholder engagement are central to my expertise, and I’m here to share knowledge or explore potential collaborations.

Please comment, share or subscribe to my LinkedIn Reputation Matters newsletter. Or connect with me on LinkedIn.